Ticker Tape does a training called the “5 Mistakes Most Investors Make.” The text below is the outline of the training, but to get the full effect, you should watch the recording of the presentation, because there is a significant amount of material that is not included in the text.

You can watch the recording by Registering Here.

Here is the outline of the presentation…

1. Failing to Conduct Adequate Due Diligence

• What is Management’s track record?

• What is the mood of existing investors?

• What Does the Operating Agreement or Bylaws Say?

• “Will the Dogs Eat The Dog Food?”

• Regulatory Concerns (Crypto/Securities/Environmental)

• Lawsuits?

• News and other Social Media commentary

• What is the valuation? Relative to peers?

• Does Management have skin in the game?

2. Not Being Diversified (Enough)

• Investing in a Fund is the best way to diversify

• Rule #1 – Don’t put it all in one deal.

• Find ways to make more, smaller bets — mix up the risk/return profile

• It takes more work, but it is worth it in the long run

• “If three out of four deals will fail, you better invest in four deals.”

• Different Asset Classes – But also diversification within Classes

3. Not Investing in Private Deals

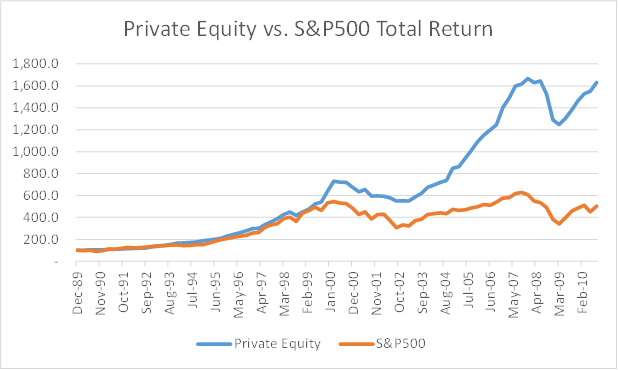

• Rule #2 – Private Deals tend to generate better returns

• Even after HIGHER fees, private equity has outperformed the public markets over the past 20 years. Massively so if you exclude the top-20 public companies.

• By the time companies go public, “the money has already been made.”

• The Jobs Act, Sarbanes-Oxley, Facebook and Google changed Wall Street forever.

• Rule #3 – Pre-IPO investing has become a CRITICAL piece of your investment portfolio.

• It is easier than ever to find private deals now.

4. Not Having a Long-Term Strategy

• Many investors get caught up in trying to make quick profits, leading to frequent trading and market timing attempts.

• Rule #4 – Don’t try to time the market (or an investment)

• Invest consistently over time

• Don’t overreact to volatility (Cat on a stove analogy)

• Don’t chase trends

• Make at least two pre-IPO investments and one other private investment every year

5. Ignoring Management Fees

• Rule #5 – Don’t Pay Management Fees!

• Index Funds, Individual stocks and deals

• Financial Advisors are very expensive

• Rule #6 – Sometimes Pay Management Fees

• Examples include SpaceX, Real Estate Deals, Deals with management components